Tax Wise Charitable Giving as Simple as 1, 2, 3

Jun 9, 2015

By: Sheila Kinman, CAP®, Chief Advancement Officer

The April 15th tax deadline is in the rear-view window. As you review your 2014 activity and filings, did you maximize available tax deductions and credits? By partnering with the giving experts at the Community Foundation of Greater Des Moines, meeting your charitable giving goals while maximizing your tax benefits, can be as simple as 1, 2, 3.

- Establish a Donor Advised Fund to reduce estate taxes.

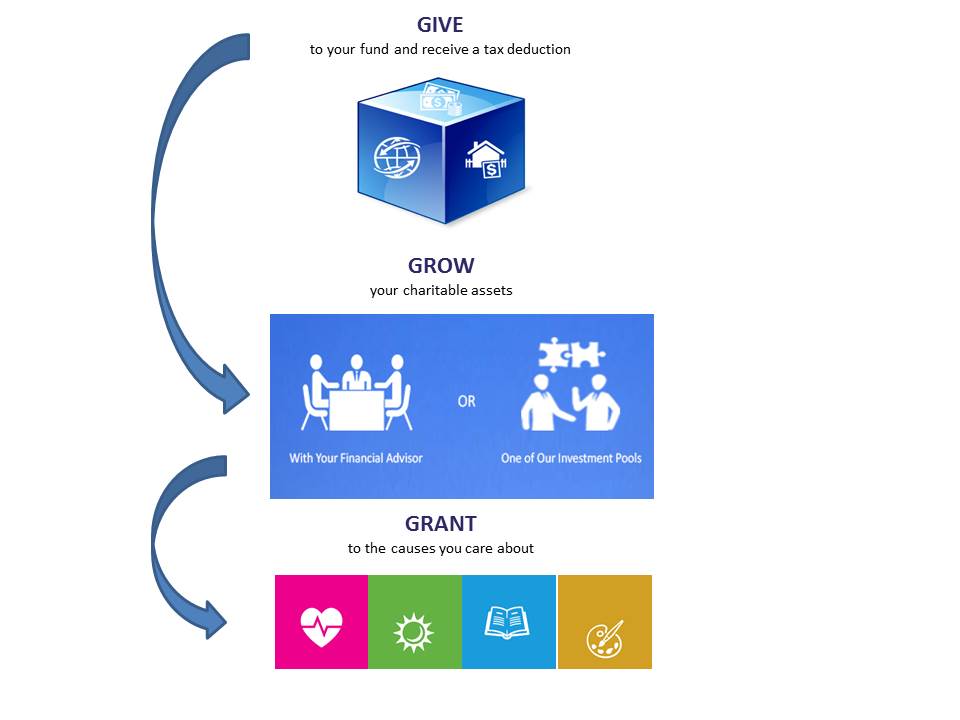

Donor Advised Funds with the Community Foundation of Greater Des Moines can act as your charitable savings account. To open a Donor Advised Fund you contribute cash or assets and receive a tax deduction for your gift. By opening a Donor Advised Fund with the Community Foundation you may also be eligible for the Endow Iowa Tax Credit program, a 25% state tax credit. The assets in your fund are then invested to grow your charitable dollars and impact. Donor Advised Funds are very personal and flexible. You recommend grants from your Donor Advised Fund to the causes and communities you care about while the Community Foundation handles the administrative details of facilitating the gift.

- Give to a qualified Endow Iowa fund and receive a 25% state tax credit available exclusively through Iowa community foundations.

The Endow Iowa Tax Credit program promotes gifts to qualified permanent endowments by awarding up to 25 percent of the amount donated as a state tax credit when making a gift through Iowa community foundations. Endow Iowa provides an opportunity to make a gift of sustainable support to the causes and communities you care about while receiving a tax credit in recognition of your investment in the future of Iowa charities.

The illustration below provides an example of the potential tax liability and tax benefit available when making a $10,000 gift to an Endow Iowa qualified fund.

Joe & Mary Taxpayer: Endow Iowa Contribution

|

Cash Gift (example of varying gift amounts)

|

$1,000

|

$10,000

|

$100,000

|

|

Less Tax Benefits

|

|

|

|

|

Net Federal Tax Savings

(appropriate assuming maximum tax bracket)

|

-396

|

-3,960

|

-39,600

|

|

Endow Iowa Tax Credit

(before federal tax effect)

|

-250

|

-2,500

|

-25,000

|

|

Net Cost of Contribution

|

354

|

3,540

|

35,400

|

*Illustration assumes the donor is in the 39.6% federal tax bracket.

- Do I hold an asset that I could gift to charity and maximize tax benefits?

You have worked to ensure you have developed a financial plan which includes diversified assets. Your charitable giving plan is no different. Our team of giving experts can assist in facilitating a variety of gift types to support the causes you care about while benefiting from maximum tax benefits.

To learn more about partnering with the Community Foundation in meeting your charitable goals contact me at kinman@desmoinesfoundation.org or 515-883-2626.

Disclaimer: This article may contain general information about legal issues and tax issues. The article does not contain legal advice and/or tax advice to any person. Materials in this article are provided "as is" and without warranty of any kind, including without limitation warranties of merchantability, fitness for any purpose, or noninfringement.